PSM

Price Sensitivity Measurement

THE PRODUCT

PSM (Price Sensitivity Measurement) is our instrument for convenient pricing analysis based on van Westendorp. It gives quick and clear insights into the price acceptance of purchasers based on this classic pricing method.

FEATURES IN BRIEF

- Calculation of all relevant price points

- Clear presentation of derived acceptable price ranges

- Covers all variants of PSM including Newton-Miller-Smith Extension to take into account likelihood to buy

- Depiction of “possible” and “certain” buyers as well as realistic buying potential

- Projection of turnover and profits

- Extensive options for individual design of graphical output

OBJECTIVE

PSM is a method for determining the optimal price. It is based around four questions:

- What price would represent a good value (is appropriate)?

- What price would be expensive, yet still acceptable?

- What price would be too cheap, thus raising doubts about quality?

- What price would be too expensive, thus ruling out any consideration of purchase?

The following statements can be derived from these questions:

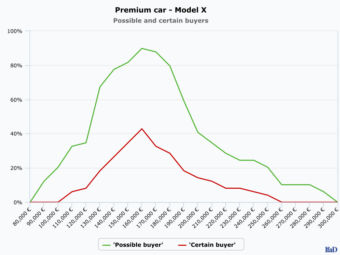

CERTAIN / POSSIBLE BUYERS

For each participant, the prices which fall between “good value” and “still acceptable” are determined. In this price range, the participant is considered to be a certain buyer. In addition, the prices between “too cheap” and “too expensive” are determined. In this price range, the participant is considered to be a possible buyer. A frequency diagram showing the relevant price range for all participants indicates the price span in which a particularly large number of certain and possible buyers can be found.

Here, the designations “certain buyer” and “possible buyer” must be put into the proper perspective. These designations are applicable under the condition that there are no competing products. In other words, they basically state whether the product would definitely or possibly be considered for purchase at a particular price. If there are several products at one particular price on the market for which there are certain or possible buyers (and this, of course, is normally the case), each of these products would only be selected by only a certain portion of this group of potential buyers. In this method, the competitive environment is not taken into account.

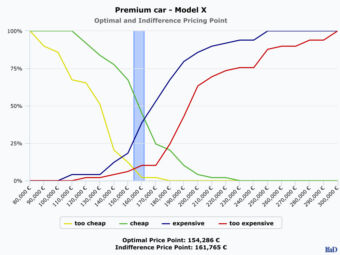

OPTIMAL / INDIFFERENCE PRICING POINT

The price point at which the number of potential customers who view the product as either too expensive or too cheap is at a minimum is known as the Optimal Pricing Point (or the Penetration Price). Here, the number of persons who would possibly consider purchasing the product is at a maximum.

The Indifference Pricing Point (also called the Perceived Normal Price) is the point at which the number of persons who view the product as being good value is equal to the number of persons who view it as being expensive.

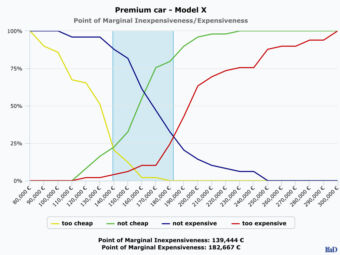

POINT OF MARGINAL INEXPENSIVENESS / EXPENSIVENESS

The frequency distributions for “good value” and “expensive” are converted into the inverse distributions “not good value” and “not expensive”.

The intersection point between “not good value” and “too cheap” is known as the Point of Marginal Inexpensiveness (also called the Lowest Reasonable Price). At this point, the number of participants who view the product as too cheap is equal to the number of persons who view it as poor value for money. If the product becomes cheaper, the number of persons who view it as too cheap will increase. If it becomes more expensive, the number of those who no longer view it as being good value for money will rise.

The Point of Marginal Expensiveness (also called the Highest Reasonable Price) is the intersection point between “not expensive” and “too expensive”. At this point, the number of participants who view the product as being too expensive is equal to the number of persons who view it as not being expensive. If it becomes more expensive, the number of participants who see it as being too expensive will increase, and conversely, the number of persons who view it as being not expensive will increase when it becomes cheaper.

The range between the Points of Marginal Inexpensiveness and Expensiveness is also known as the Range of Pricing Options. The market price should be located somewhere between these points.

NEWTON-MILLER-SMITH EXTENSION

In determining the certain and possible buyers, the competitive situation is ignored. Using the Newton-Miller-Smith extension, however, a realistic potential buyer can be determined.

For this purpose, the purchase probabilities for the price “cheap” and “expensive, but still acceptable” are also surveyed. Since the product would definitely not be bought at the prices “too cheap” and “too expensive” (the purchase probability is zero up to the price “too cheap” and from the price “too expensive”), the individual purchase probability can thus be determined for each price. An interpolation is carried out for prices between “too cheap” and “too expensive”. The realistic buyer potential at a price then corresponds to the mean value of the purchase probabilities at this price across all respondents.

If the population of the potential market is known, the potential sales can also be extrapolated at each price. If the costs of the product are also known, the profits can also be forecast.